It’s common sense that owners of products, equipment, and assets want a maximum of uptime at minimal operational cost. But how much emphasis does this get in the procurement cycle? For many buyers, defining the service requirements over a multi-year lifecycle is difficult. At the same time, buyers do have implicit expectations regarding lifecycle support, often derived from brand perceptions. This is a nice mix for OEMs to strategize on.

The bulk of lifecycle cost is in operating the asset

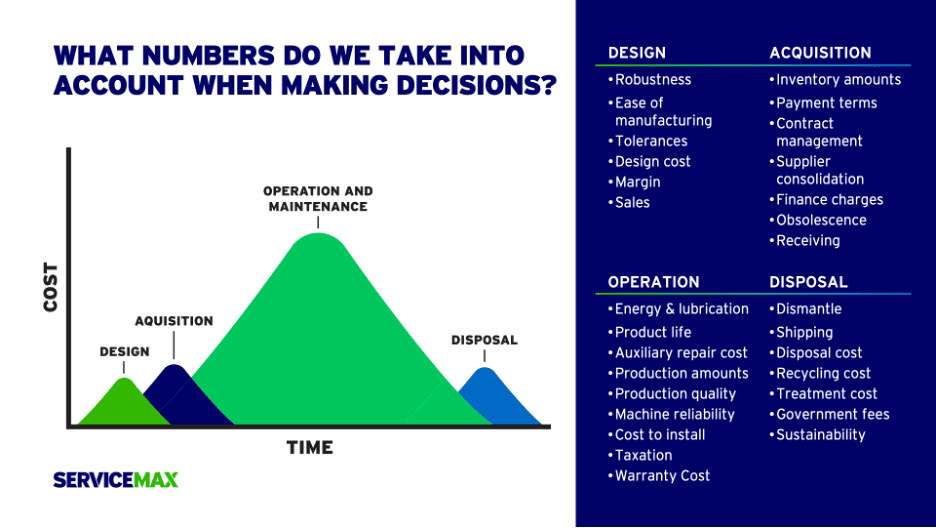

To create an asset lifecycle strategy, you have to look at it from cradle to grave, including both the OEM and the asset owner’s perspective. In the following picture, you can see the cost elements that go into each phase.

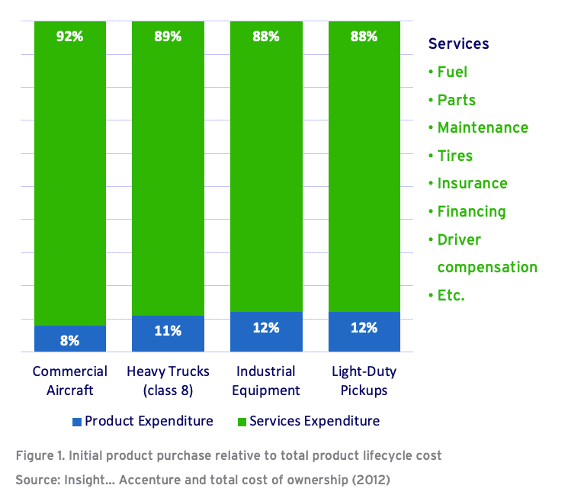

What you can see in the picture is that the cost of operating and maintaining the asset is typically a multiple of the cost of acquiring the asset. In the image from Accenture below, the ratio between product expenditure (CapEx) and service expenditures (OpEx) comes to life. Eg, if you had purchased a piece of industrial equipment for $1m, you would spend an additional $7.3m over its lifecycle to keep it running.

Nominal output of the asset

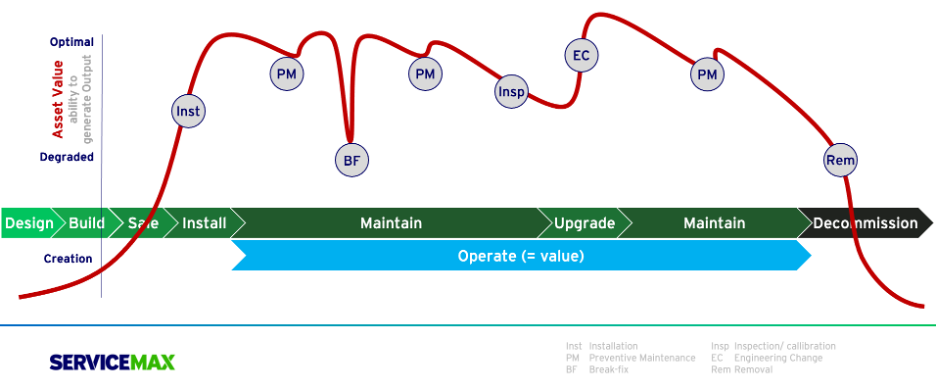

Let’s go back one step. Why does somebody buy an asset? Not for the pleasure of owning it, but to use it. In using it, the asset produces a nominal output/outcome, and that generates value for the asset owner. To maintain the nominal output while wear-and-tear is degrading the asset, a mitigating lifecycle strategy needs to be put in place to secure the value potential of the asset. The following picture shows a typical asset lifecycle.

In this picture, you’ll see service interventions like preventive maintenance and break-fix that serve the purpose of uptime. An intervention like an engineering change serves the purpose of prolonging the lifecycle of the asset as well as potentially boosting the original nominal output.

- Extending lifecycle: mid-life upgrade, retrofit, or overhaul.

- Expanding output: booster packs, product or software upgrades.

Product engineering beyond point-of-sale

Both extending the lifecycle and expanding the nominal output of an asset can be plotted against the continuous process of product engineering. Once a product hits the street, engineering receives feedback on its use through quality, warranty, and maintenance channels.

Acting on asset feedback, engineering can design newer revisions of that product as well as define upgrade and booster offerings for the existing installed base.

For some OEMs, the asset feedback loop is an integral part of their Go-to-Market. Imagine you operate in a very competitive and tech-savvy market. Timing is essential in building market share. At ServiceMax, we’ve come across OEMs that go GA with a product when engineering is at 80%. They use the service organization to ‘bestow’ the customer with goodness and attention to make up for the missing 20%. In doing so, the service organization retrieves relevant intelligence to complete the engineering process. As part of the deal, the customer gets the benefit of both the latest technology and engineering changes post-point-of-sale. A win-win for both the OEM and asset owner.

Using the product lifecycle as a means to customer intimacy

Whether you launch your product at 80% engineering completeness or at 100%, most OEMs will continue to engineer their product beyond GA. The question is, how would you like to make those product improvements and engineering changes accessible to your existing installed base? In other words, have you set up a process to manage asset lifecycle service campaigns?

Service campaigns can stem from two different emotions. A negative and a positive one. In the end, when you manage your campaigns well, you’ll achieve higher levels of customer intimacy.

- Negative emotions: These are quality and complaint-driven engineering changes. A customer expects a certain quality and nominal output level but is not getting it. The customer expects the supplier to fix it as quickly as possible at no extra cost. Though a complaint and quality issue may start as a negative emotion, an OEM’s capability to act on it determines if the emotion remains negative or turns positive. In addition, service campaign capabilities will deliver efficiency and compliance benefits to the OEM.

- Positive emotions: These are engineering changes that will enhance the capabilities of the asset. You go above and beyond the nominal output specifications promised at point-of-sale. In general, customers will perceive this as a positive, adding credibility to the OEM’s leadership and brand value. With service campaigns, an OEM can reinforce that positive emotion as well as monetize it.

Service campaigns drive proactive service

If customers buy assets to use them, OEMs are very well positioned to facilitate the usage of those assets throughout their lifecycle. The OEM designed the product. The OEM has all the expert knowledge of how and why the product works. Now, if the OEM gets feedback on how each individual asset performs in the field, the OEM is sitting on a gold mine of data, ready to be servitized and monetized. The vehicle to deliver those services to the installed base is called: service campaigns.

Share this: